Investment Banking

Axis Capital’s dominance in Investment Banking services comes from 37 years of market-leading activity and deep partnerships with corporates and institutional investors. Our solutions extend to:

- M&A: we manage highly complex transactions across a swathe of sectors and sizes involving domestic and cross-border transactions

- ECM: India’s #1 ECM Banker over the past decade, having brought more than 50 new sectors to the capital market

- InvITs-REITs-SF: as pioneers of InvITs-REITs in India, Axis Capital has a clutch of award-winning firsts to its credit in this product

- Private Fund Raising (PFR): Private equity firms, venture capital funds and family offices benefit fromcapital raising as well as strategic guidance and operational expertise

Institutional Research

Top-tier research from one of the largest and best quality research teams on the street. Axis Capital offers waterfront coverage of a large and growing number of exciting firms of interest to domestic and foreign institutional investors. Key differentiators:

- Coverage depth as well as breadth

- Alpha-generating research

- Macro and micro focus – from prolific thematic research to channel-check series

- Annual Report Analysis (ARA) for strategic priorities and forensic accounting insights.

Institutional Equities

A leading institutional broker with a full suite of offerings – from research to strong corporate access, cash, derivatives and electronic trading. Axis Capital is the preferred partner for institutional investors. Highlights:

- Strong relationships with >500 leading institutional investors across India, US, Europe, Far East and the Middle East

- Comprehensive suite of execution services across cash and derivatives with high touch and electronic trading capability

- Access to unique pools of liquidity across large and mid-market segments.

-

Insights

-

Awards

-

2026

test award 2026

By: Testi Money -

2019

Most Innovative Investment Bank (Asia Pacific)

By: The Banker -

2024

India’s Best Investment Bank

By: Asiamoney Award -

2024

"Best Investment Bank Best Securities House in India"

By: Euromoney Securities Houses Awards -

2024

Best Investment Bank | Domestic

By: Finance Asia Achievement Awards

Transactions

-

Lenskart Solutions

Lenskart Solutions

Limited₹ 900 MnIPO Nov 2025

-

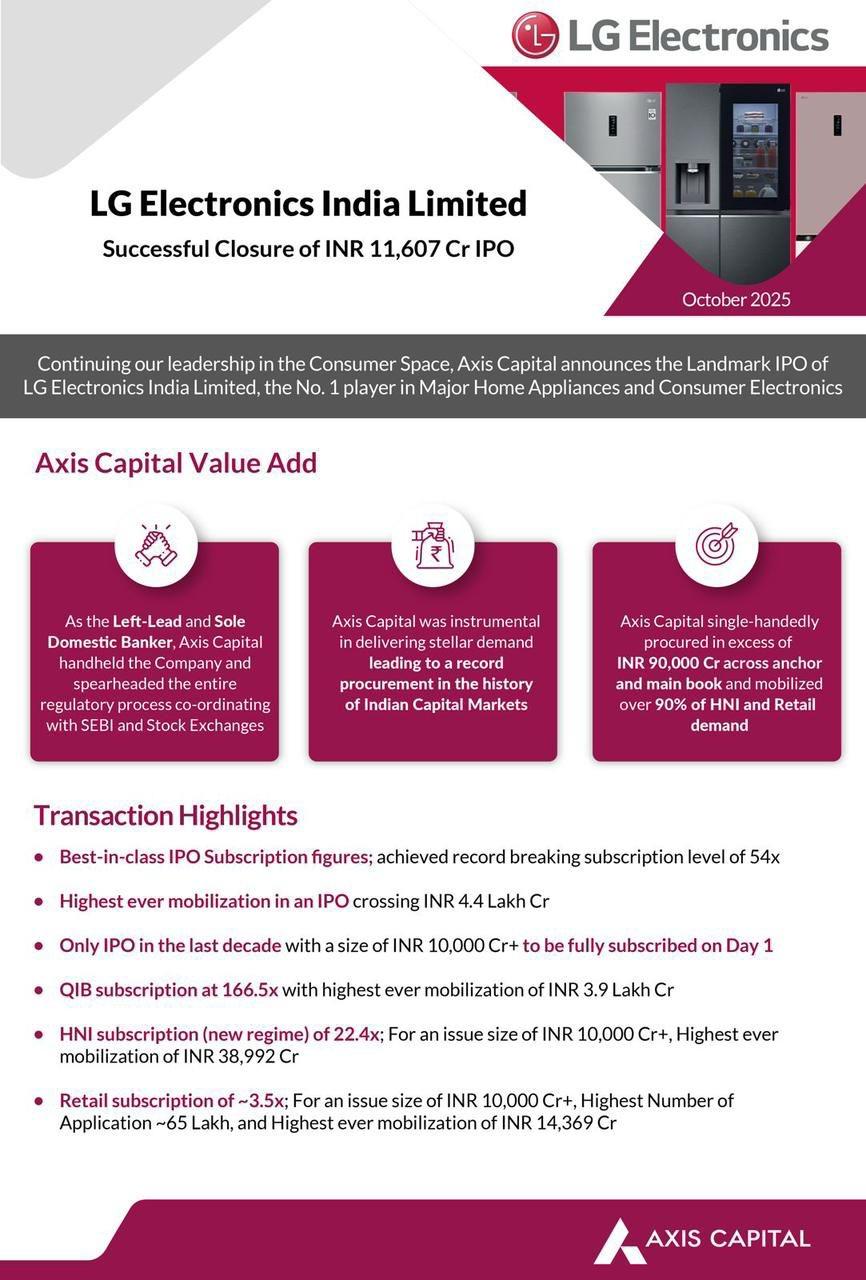

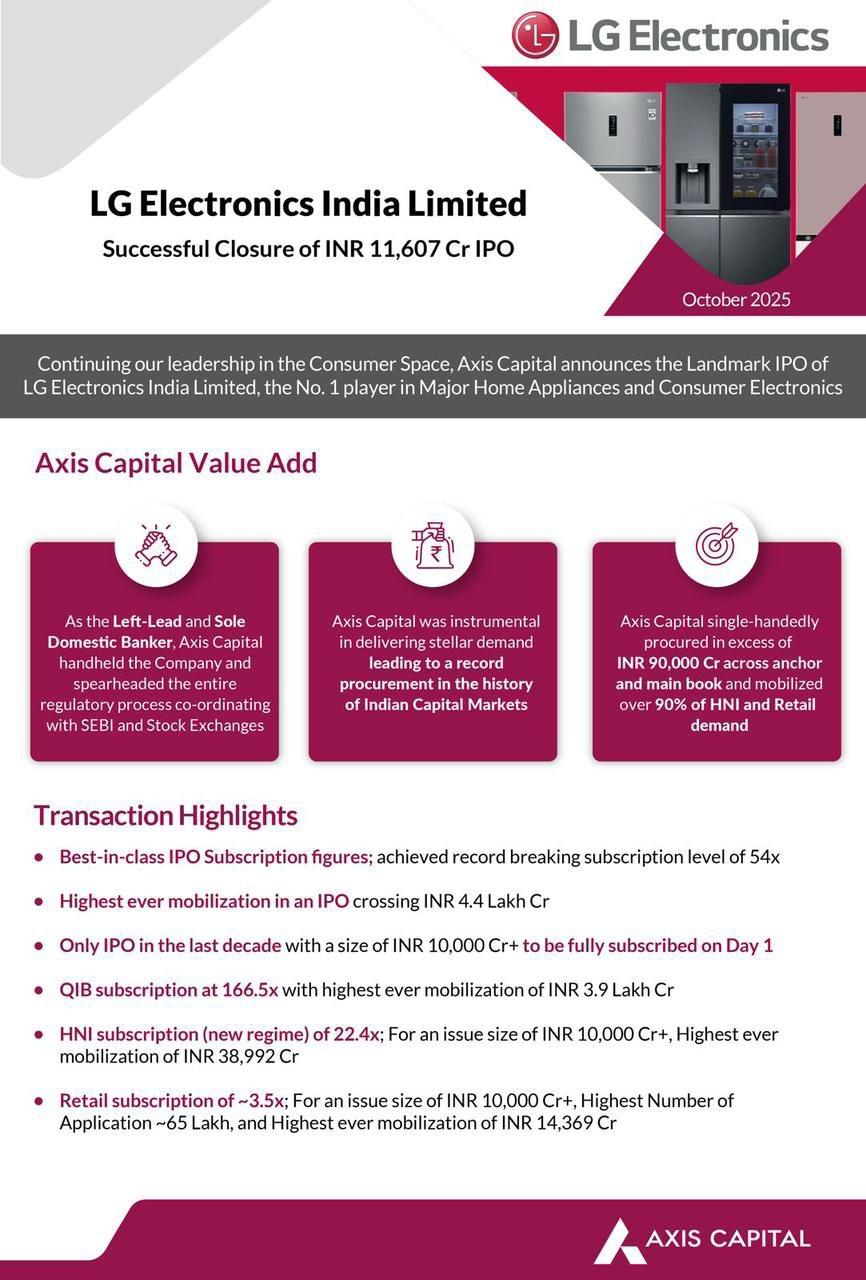

LG Electronics India LTD₹ 999 Mn

LG Electronics India LTD₹ 999 MnXYZ Nov 2025

-

Test PVT Ltd₹ 2,000 Mn

Test PVT Ltd₹ 2,000 Mntest page Nov 2025

-

LG Electronics₹ 500 Mn

LG Electronics₹ 500 MnIPO Nov 2025

-

Cholamandalam Investment

Cholamandalam Investment

And Finance Company

Limited₹ 100 MnIPO Jul 2025

-

Hindustan Zinc Ltd₹ 5,334 Mn

Hindustan Zinc Ltd₹ 5,334 MnOFS(SE) Nov 2024

-

Himatsingka Seide Ltd₹ 400 Mn

Himatsingka Seide Ltd₹ 400 MnQIP Oct 2024

-

Waaree Energies Ltd.₹ 4,321 Mn

Waaree Energies Ltd.₹ 4,321 MnIPO Oct 2024

-

Cochin Shipyard Ltd.₹ 2,011 Mn

Cochin Shipyard Ltd.₹ 2,011 MnOFS(SE) Oct 2024

-

Waaree Energies Limited₹ 43,210 Mn

Waaree Energies Limited₹ 43,210 MnIPO Oct 2024

-

Samvardhana Motherson

Samvardhana Motherson

International Ltd.₹ 6,438 MnQIP Sep 2024

-

Akums Drugs &

Akums Drugs &

Pharmaceuticals Ltd.₹ 1,857 MnIPO Jul 2024

Testimonials

Insights Details

-

December 10, 2024

December 10, 2024IT Services: GenAI – millennium shapeshifter to transform services

GenAI–our word of the year–could generate 20-40% savings in the software development lifecycle. We see no risk to tech spends with these savings being ploughed back into innovative tech for better business. Prospective TAM and margin gains make us ask – is Services as a Software the new SaaS?

-

December 10, 2024

December 10, 2024IT Services: GenAI – millennium shapeshifter to transform services

GenAI–our word of the year–could generate 20-40% savings in the software development lifecycle. We see no risk to tech spends with these savings being ploughed back into innovative tech for better business. Prospective TAM and margin gains make us ask – is Services as a Software the new SaaS?

-

December 10, 2024

December 10, 2024IT Services: GenAI – millennium shapeshifter to transform services

GenAI–our word of the year–could generate 20-40% savings in the software development lifecycle. We see no risk to tech spends with these savings being ploughed back into innovative tech for better business. Prospective TAM and margin gains make us ask – is Services as a Software the new SaaS?

-